Pay As You Go

Simplify Your Workers’ Compensation Payments

A Flexible Approach to Workers' Compensation Insurance

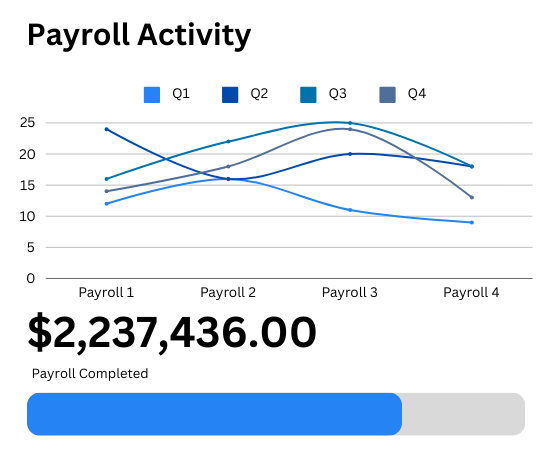

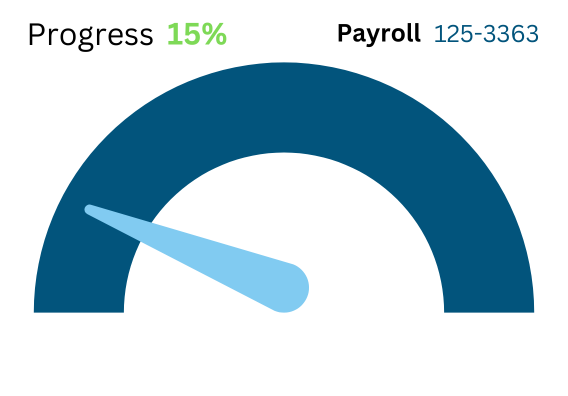

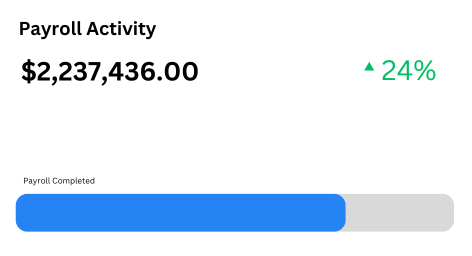

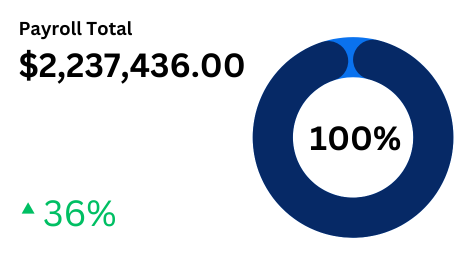

Pay As You Go” (PAYGO) is a flexible payment method for workers’ compensation insurance that aligns premium payments with your payroll cycles. Instead of paying large upfront premiums, employers using PAYGO make smaller, incremental payments based on their actual payroll data.

How Does Pay As You Go Work?

With Cennairus’s Pay As You Go program, you can streamline the payment process for workers’ compensation insurance. Here’s how it works:

Run

Payroll

as Usual

Continue with your regular payroll process to ensure accurate employee counts and wage data.

Automated Premium Calculation

We calculate your premium each payroll cycle based on your most recent payroll data, eliminating the need for large lump-sum payments.

Direct Payment to Insurer

The calculated premium is automatically deducted and sent to your insurance provider, removing the hassle of writing checks or managing payment deadlines.

Key Benefits of Pay As You Go

With Pay As You Go Workers’ Compensation, employers gain several valuable benefits, including:

Reduced

Upfront Costs

By eliminating or significantly reducing down payments, you free up capital for other business needs.

Elimination of Premium Financing

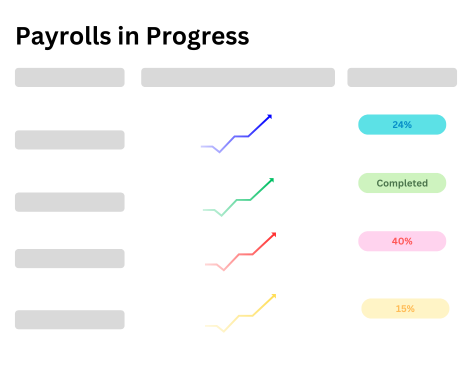

Easily view the status of any payment, anywhere and anytime, connect Monoline, reconciliation is automatic.

Fewer

Administrative Tasks

No more checks to write or premium financing to manage, simplifying your payroll process.

Reduced

Audit Risk

It’s easy for your customers to make one-time instant payments or set up for automatic payments.

Improved Cash Flow

The flexibility of the Pay As You Go approach allows you to budget more effectively, adjusting premiums based on payroll changes.

Potential

Cost Savings

By adjusting premiums to actual payroll, you might see a lower overall cost of workers’ compensation coverage.